Full Cost Accounting: What, Why, and How

NRRA Full Cost Accounting Analysis Report

NRRA created Full Cost Accounting (FCA) models and analyses for five New Hampshire town transfer stations based on their 2023 Fiscal Year.

Full Cost Accounting can help towns educate residents, make data-driven decisions and program changes, and can be used for financial planning, fee and rate setting, and vendor negotiations.

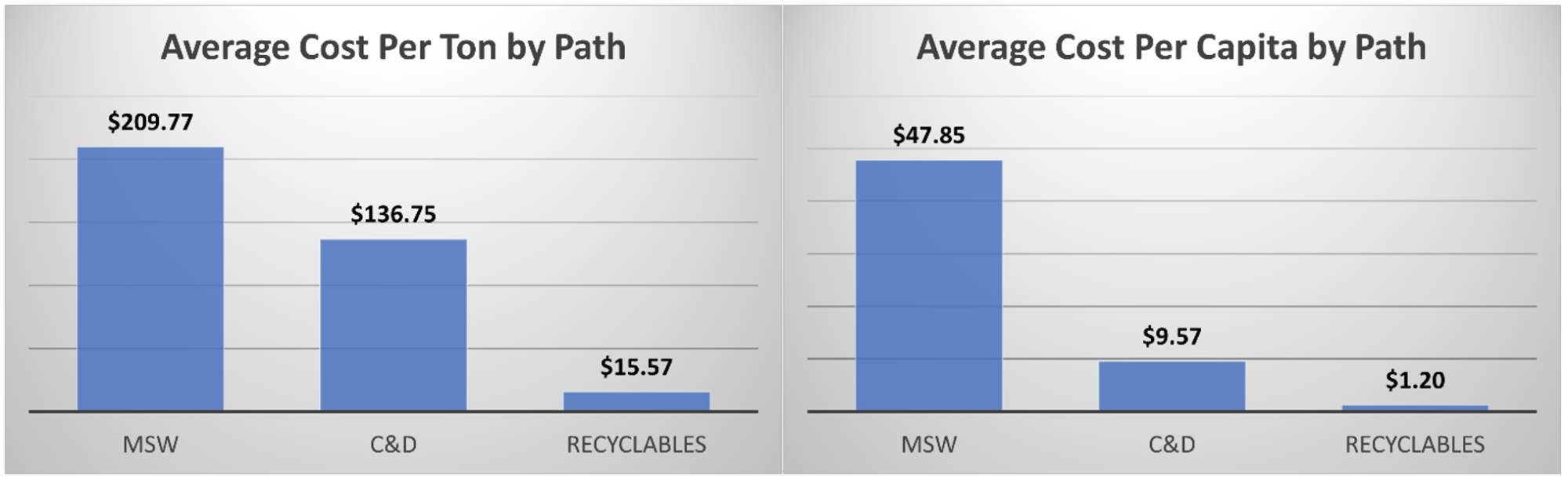

Each model calculated the cost per ton and cost per person for municipal solid waste (MSW), construction and demolition debris (C&D), and recycling.

The FCA model was created using detailed Transfer Station expense and revenue budgets, the summary town budgets from each Town’s finance department, and additional data specifics from each Transfer Station Manager. NRRA did not calculate any depreciation or future outlays as the towns were not able to provide the needed information.

AVERAGE ESTIMATED COSTS PER TON:

MSW: $209.77 C&D: $136.75 Recycling: $15.57

Transfer Station Cost Per Ton: $156.25

KEY TAKEAWAYS: Overall, the cost per ton for the five transfer stations ranged from $86.73 per ton to $190.89 per ton with the average being $156.25 per ton. MSW was by far the costliest path at an average of $209.77 per ton while recycling was the lowest cost per ton at $15.57 per ton.

The results show that recycling is well worth the effort, as it is 92.5% cheaper than MSW!

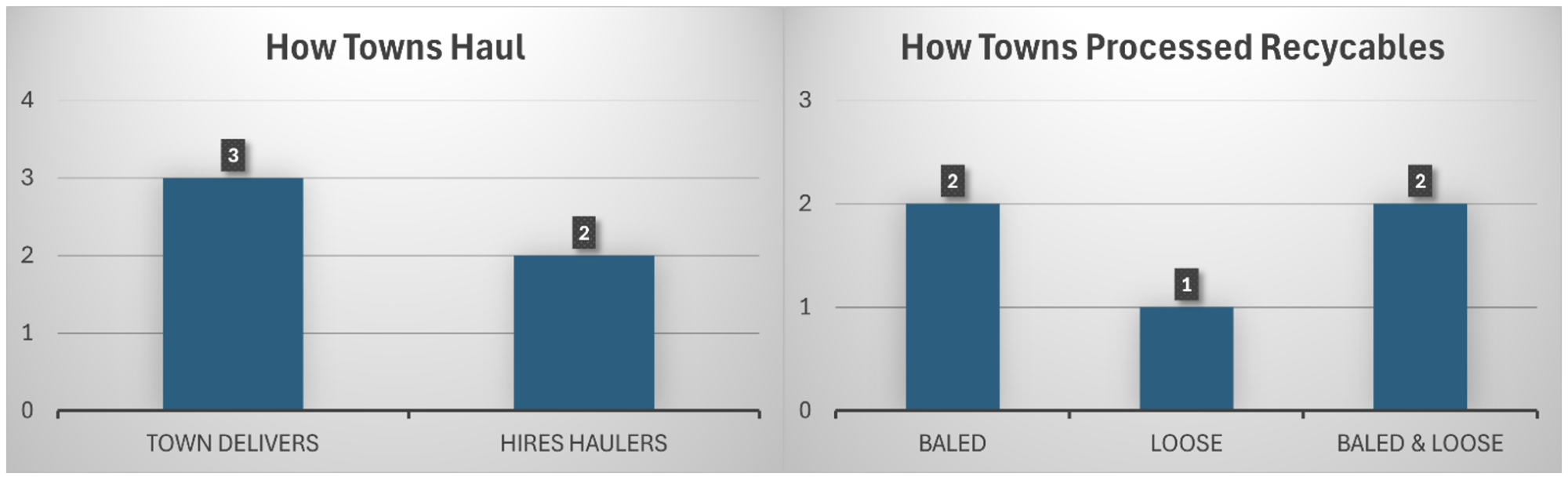

EQUIPMENT: Each town processes and handles their recycling differently. Two towns have multiple balers and bale all their recycling. Two towns bale some of their material and send some loose to be processed at a larger facility. One town does not bale and sends all recycling out to be processed. Three of the towns also haul their own material (MSW, C&D, loose recycling) using town equipment and town workers.

PATHS: The analysis separated numbers into different paths. All included MSW, C&D, and Recycling. Another major path is Composting, but tonnages are estimated. One town, Warner, had enough data to split the recycling into more subcategories.

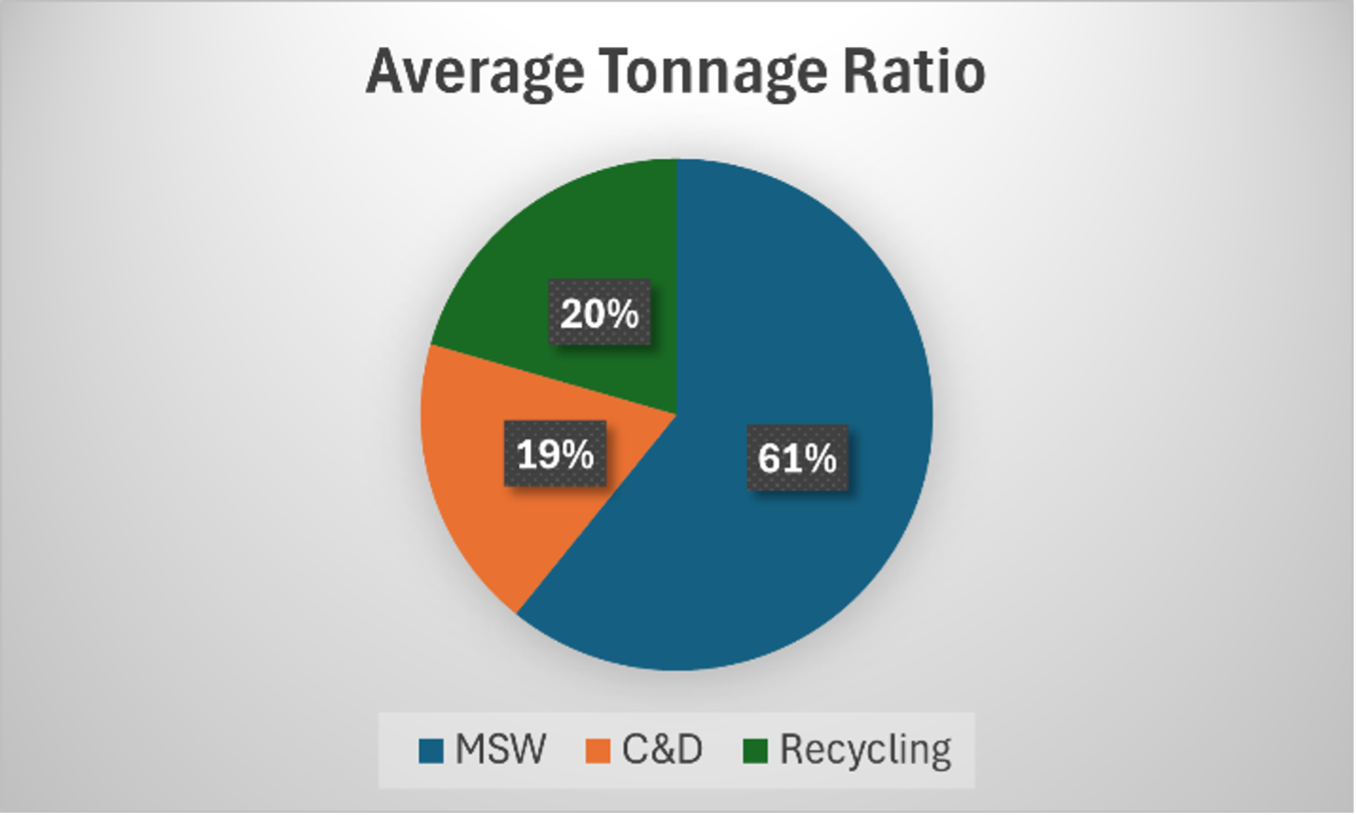

ALLOCATIONS: NRRA offered two allocation ratios: the work hour ratio split the average weekly hours into the different paths, while the tonnage ratio calculated the total tonnage the facility accepted into the different paths. All five towns elected to use the tonnage ratio for their default ratio, which is the default calculation for each line. The default ratio can be changed on every line in the FCA analysis.

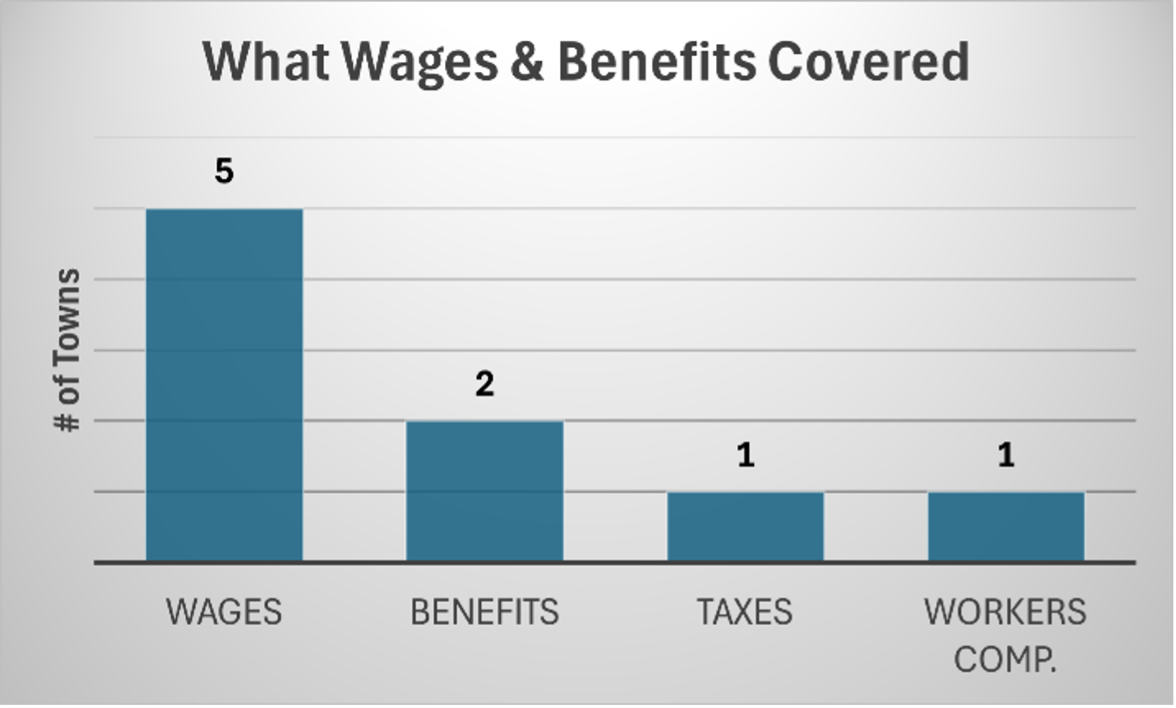

WAGES & BENEFITS: Wages are simple to calculate as most town wages are included in a transfer station budget. NRRA found that benefits (such as insurance and retirement), taxes, and worker’s compensation insurance are sometimes included in a transfer station budget and sometimes mixed into the general budget. NRRA recommends calculating these separately and putting them into the transfer station budget. As shown in the chart below, while all five towns were able to provide wage data, only one or two could provide data regarding benefits, taxes, and workers compensation.

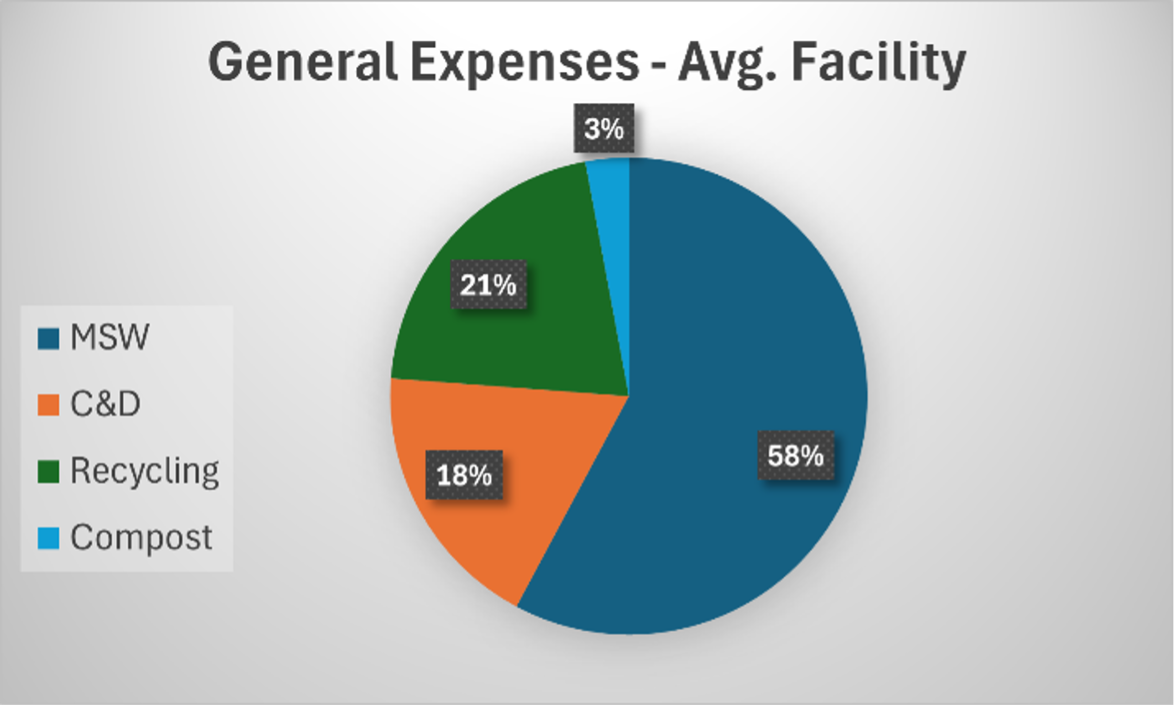

GENERAL EXPENSES: This category covers non-wages and non-benefit expenses; large expenses include disposal fees, transportation fees, and repairs; and small expenses include utilities, mileage, and supplies. The average of the five towns saw $144,841 in general expenses with an average of 58% ($83,736) going towards MSW. Recycling accounted for only 21% of the average facility expenses.

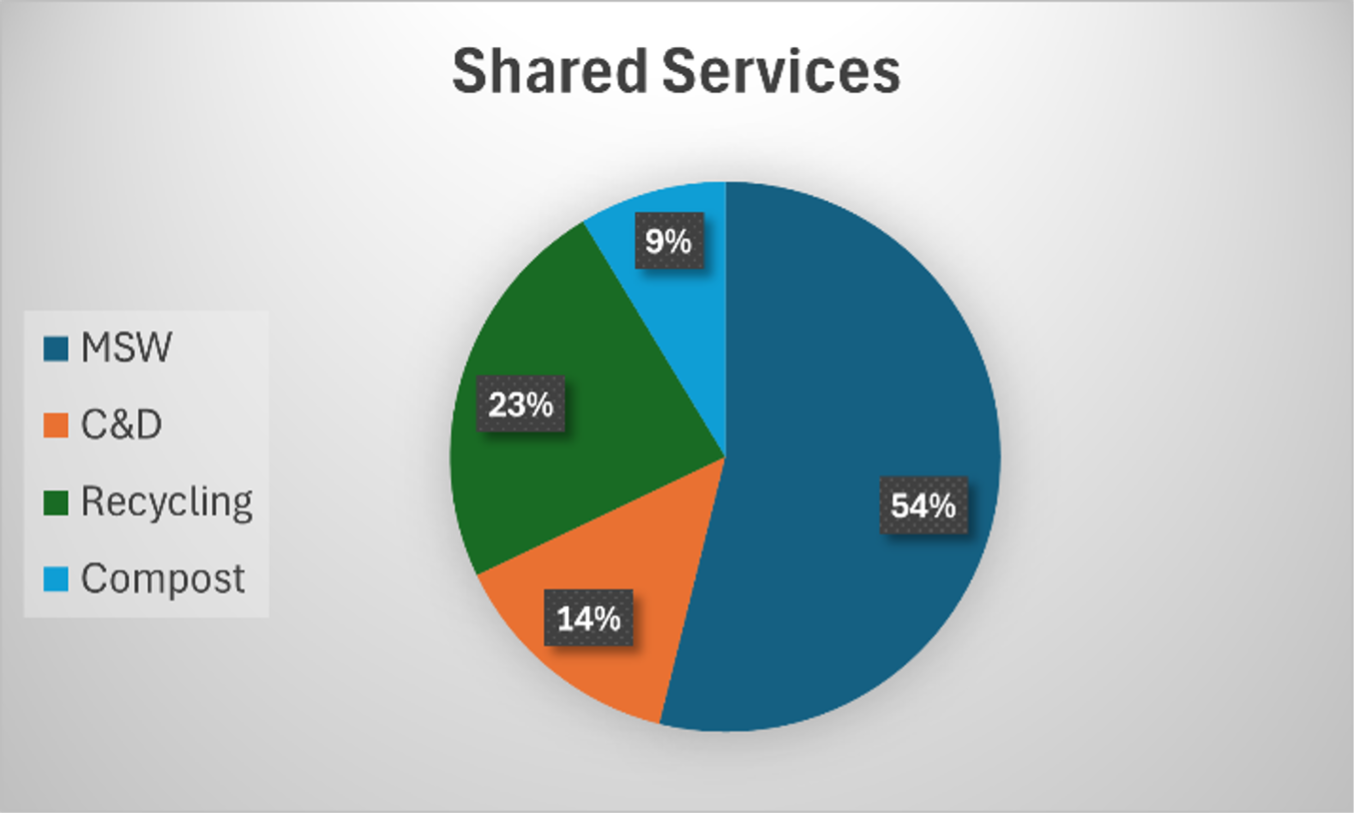

SHARED SERVICES: Lacking concrete data, NRRA estimated that the average Transfer Station had $113,415 in shared service expenses with other town departments. The Transfer Stations were responsible for the use of approximately 5% to 7.1% of town departments such as finance, executive, human resources, and others. This was calculated based on the percentage of the Transfer Station budget compared to the whole town budget. NRRA used the tonnage allocation percentages to calculate expenses out by path. NRRA was able to calculate shared service expenses for four of the five towns.

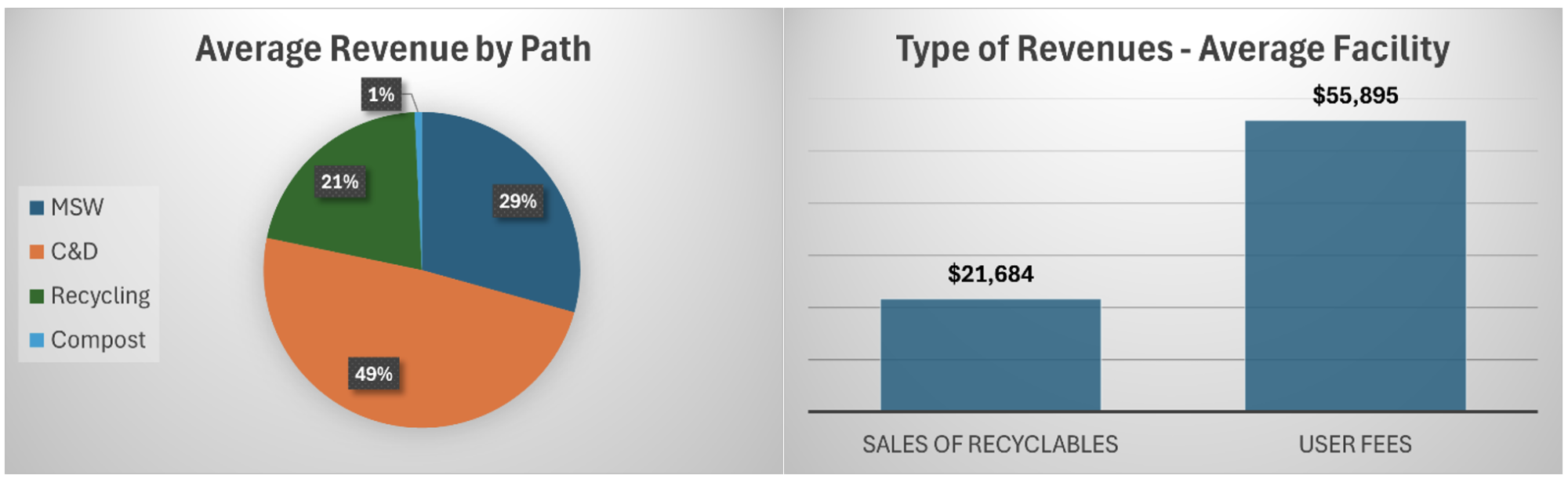

REVENUES: The average town saw $70,384 in revenue from their Transfer Station. Around 49% ($34,449) was from C&D. It is important to note that 2023 was a down year for recycling markets, which accounts for recycling only being 21% ($14,776) in revenue. In addition, most of the towns that participated either do not bale, or bale only certain types of recyclables. Baled recyclables tend to result in higher revenue.

LESSONS LEARNED:

While Full Cost Accounting can be a useful tool for towns to educate residents and make data-driven decisions and program changes, NRRA found it difficult to find towns willing to have an analysis done for their Transfer Station.

The major reason towns stated they could not participate was because the Transfer Station Manager did not have extra time to spend on this project, though NRRA explained the process would not take much time. Most of the facilities reported they were understaffed or there were many new employees that did not have knowledge of the budget yet. The manager at the Hillsboro Transfer Station, for example, wanted to participate but needed to wait until the following year to get more familiarized with the budget.

Another issue NRRA discovered was that many small towns do not have clear recordkeeping systems and that the Transfer Station budget combines many categories, which makes it extremely difficult to calculate accurate numbers. For example, one of the five towns did not know which budget line the recycling revenue was recorded under. Another example is that many towns have all the town employee taxes, retirement, and insurances in one account in the general budget.

Finally, NRRA took out all depreciation and future outlay sections, as none of the towns had completely accurate numbers for these sections. Incomplete numbers would have falsely raised the costs of certain paths over others. For example, one town did not know what the purchase year and price was for a baler but did know the numbers for their MSW compactor. By adding the incomplete data, it would have unfairly adjusted the MSW path but not the Recycling path.

This material is based in part upon work supported under a grant by the Rural Utilities Service, United States Department of Agriculture. Any opinions, findings, and conclusions or recommendations expressed in this material are solely the responsibility of the authors and do not necessarily represent the official views of the Rural Utilities Service. Rural Community Assistance Partnership, Inc., is an equal opportunity provider and employer.

Northeast Resource Recovery Association complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability, or sex (including pregnancy, sexual orientation, and gender identity).