Littleton Transfer Station Construction & Demolition Full Cost Accounting for FY23

The Northeast Resource Recovery Association (NRRA) created a Full Cost Accounting (FCA) model and analysis for the Littleton, NH Transfer Station based on the 2023 Fiscal Year. Full Cost Accounting can help towns educate residents, make data-driven decisions and program changes, and can be used for financial planning, fee and rate setting, and vendor negotiations. The primary focus of the FCA model was the financial impact of Construction and Demolition Debris (C&D) and Bulky Waste on Littleton’s solid waste operations. Because Littleton mixes these two types of material together, this combination will be referred to as C&D for the purposes of this report.

The FCA model was created using detailed Transfer Station expense and revenue budgets, the summary town budget from the Town’s finance department, and additional data specifics from the Transfer Station Manager. NRRA did not calculate any depreciation or future outlays as the town was not able to provide the needed information.

BY THE NUMBERS:

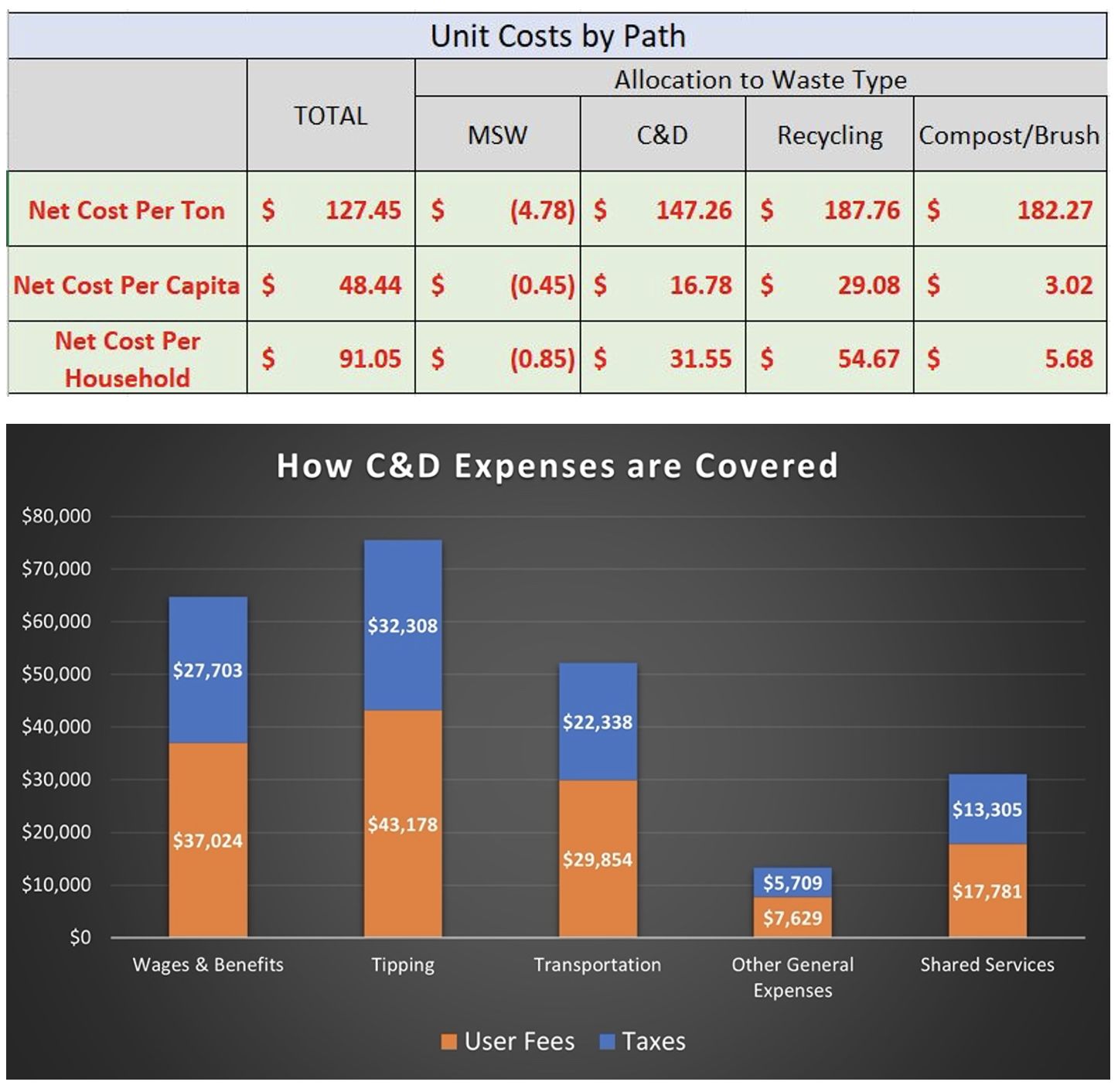

Tons Landfilled: 688 Cost Per Ton: $147.26

Population: 6,036 Cost Per Capita: $16.78

Households: 3,211 Cost Per Household: $31.55

KEY TAKEAWAYS:

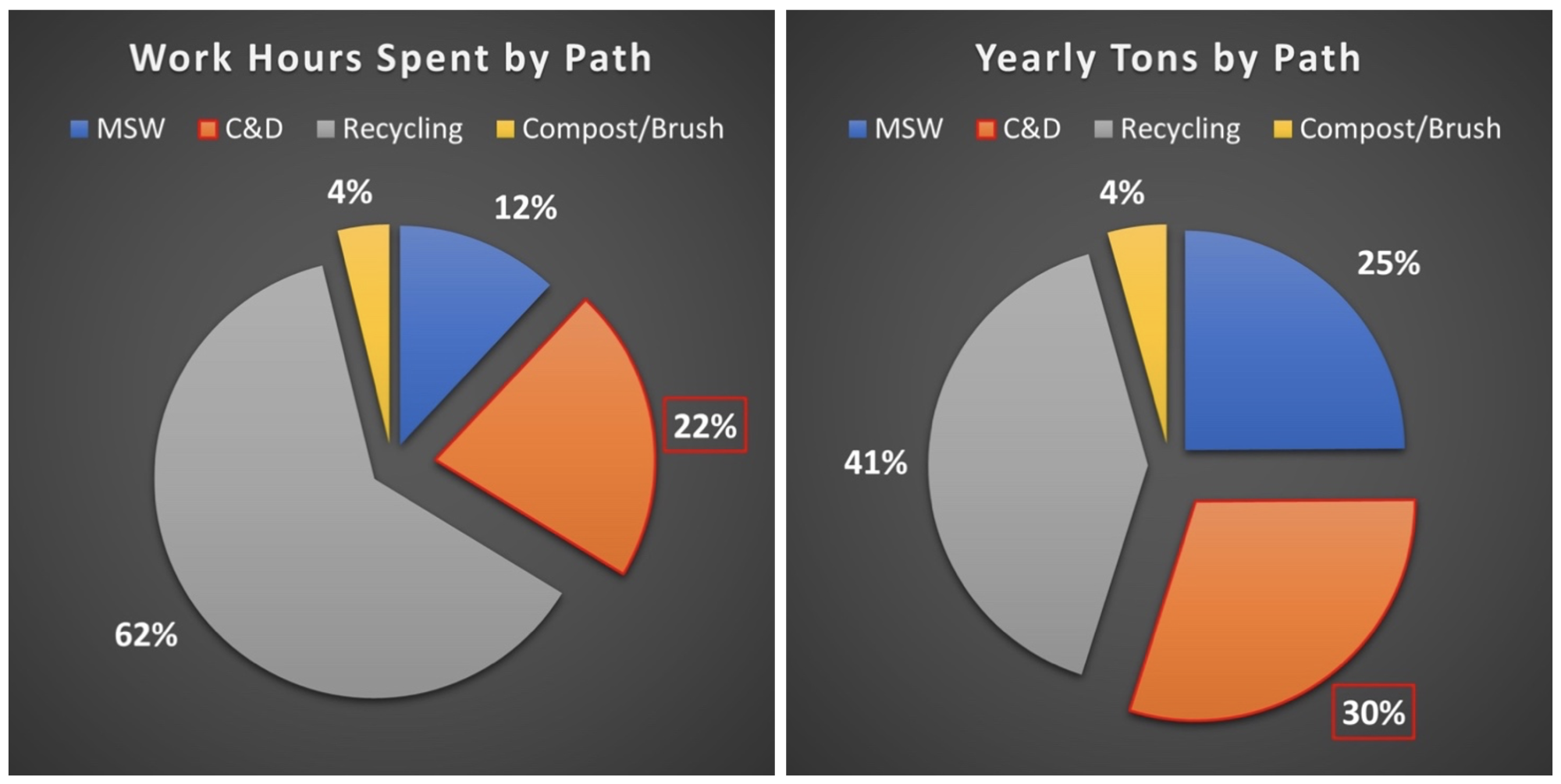

C&D accounts for 22% of total labor time and 30% of materials accepted at the transfer station. (In contrast, recycling accounts for 62% of labor time and 41% of materials accepted.) The town covers nearly 57% of its C&D expenses with user fees. While the revenue from these fees covers disposal (aka tipping) and transportation costs, other expenses such as labor, repairs, or town shared services are not.

Based on this FCA analysis, NRRA recommends that the town have a strategic discussion about opportunities for increasing C&D recycling and decreasing C&D costs using the recommended discussion points at the end of this report.

Based on this FCA analysis, NRRA recommends that the town have a strategic discussion about opportunities for increasing C&D recycling and decreasing C&D costs using the recommended discussion points at the end of this report.

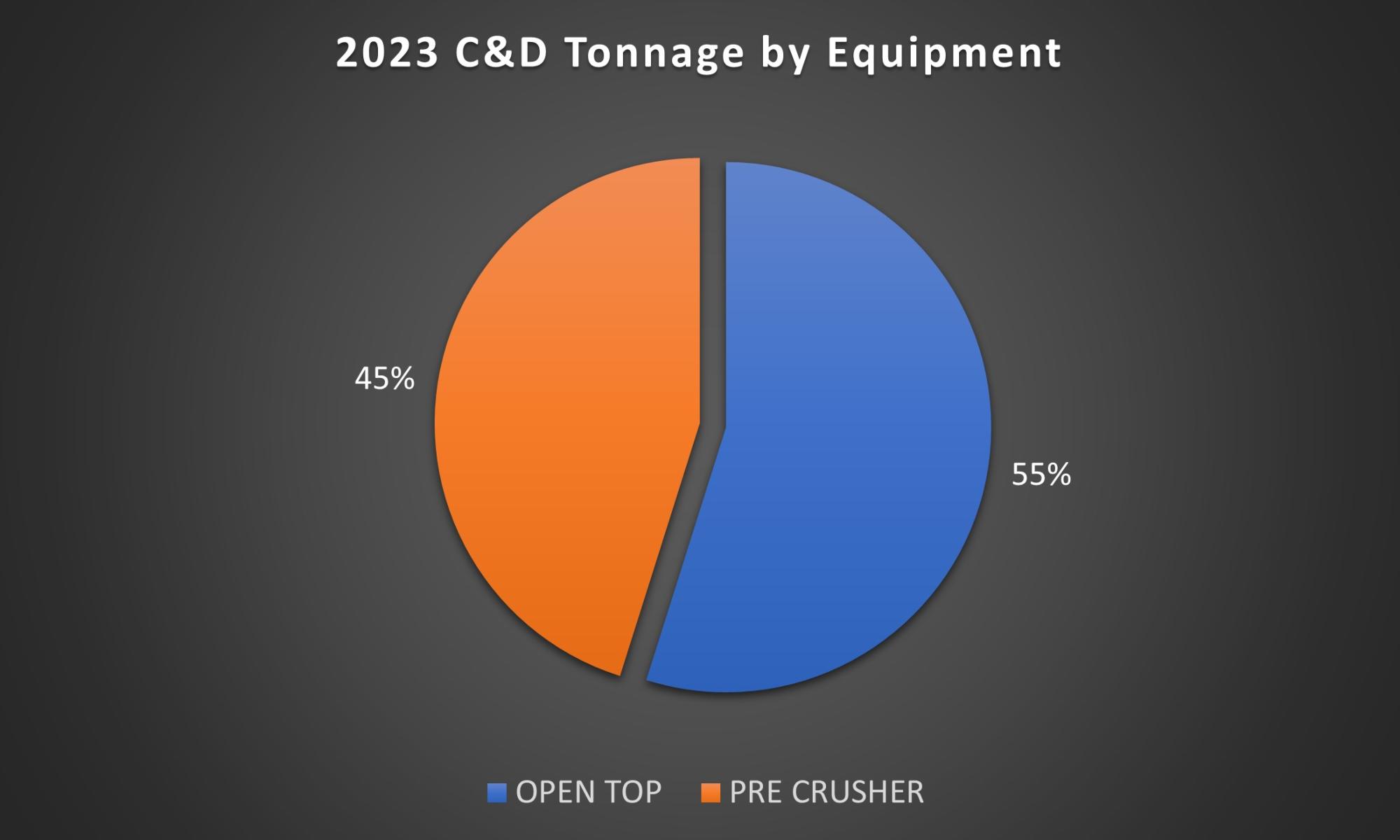

EQUIPMENT: Littleton uses both an open top container and a pre-crusher for C&D. The open top is used primarily for large loads and hard to handle items. The facility uses a front-end loader to load and crush the material. The pre-crusher is used primarily for bulky items and small loads from residents.

In 2023, Littleton received a daily average of 3,765 pounds of C&D. Further, 95 loads of C&D were sent to the NCES Landfill in Bethlehem, with a breakdown of 53 loads of open top containers and 42 loads of pre-crusher containers.

ALLOCATION: From a labor standpoint, 40 of the 184 hours worked per week at the transfer station were spent on handling C&D, which equates to 22% of total labor time spent. Alternatively, the breakdown of C&D total tonnage was 688 of the 2,294 tons of all material accepted at the facility, which equates to 30% of the accepted material. Therefore, C&D accounted for 22% of total labor time and 30% of materials accepted at the transfer station.

In contrast, recycling accounted for 62% of labor time and 41% of materials accepted.

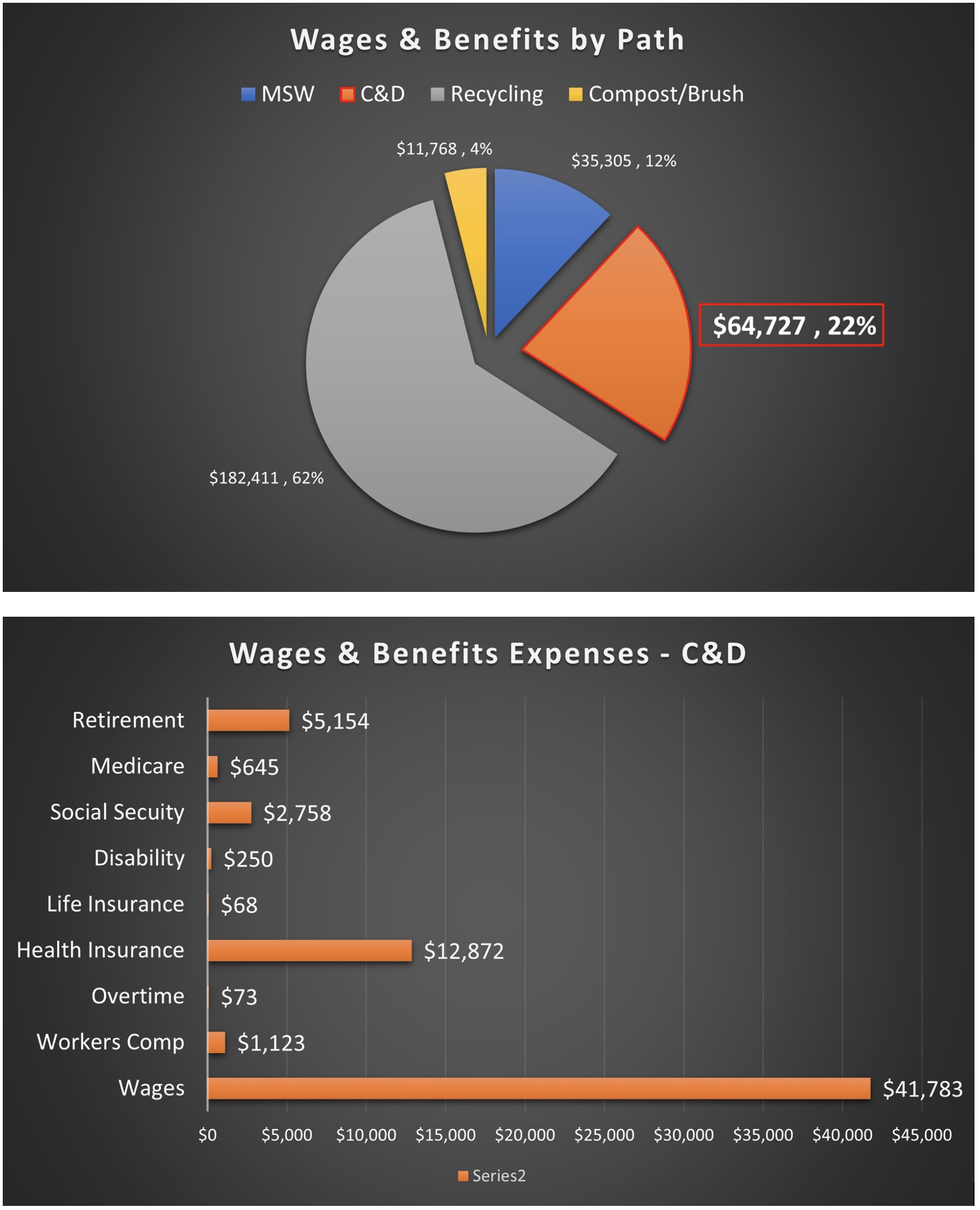

WAGES & BENEFITS: NRRA used the labor allocation ratios to calculate the wages and benefits spent on each path – C&D, recycling, and Municipal Solid Waste (MSW). This included wages, insurance, taxes, and retirement. A total of $64,727 was spent on handling C&D; of this, wages accounted for approximately 64.5%.

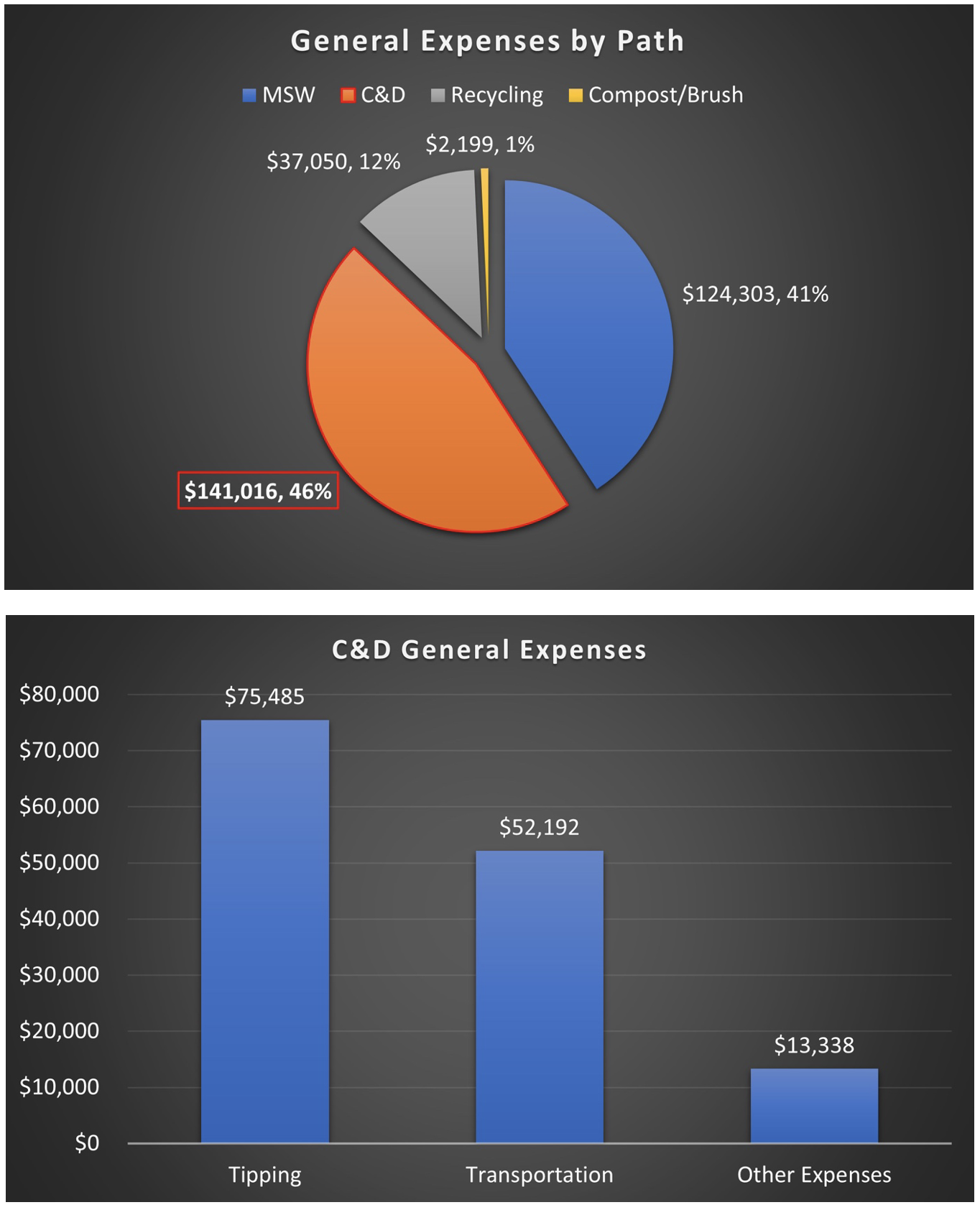

GENERAL EXPENSES: This category covers non-wages and non-benefit expenses. Large items include disposal and transportation fees, and categories like repairs, district dues, utilities, and supplies. Overall, the facility had $284,121 in general expenses of which nearly 50% was associated with C&D.

Of the $141,016 in general expenses for C&D, tipping and transportation fees accounted for 90.5%. Specifically, tipping was $75,485 (53.5%) and transportation was $52,192 (37%). The remaining $13,338 was split between 19 other categories, the largest being fuel, utilities, dues, and property insurance.

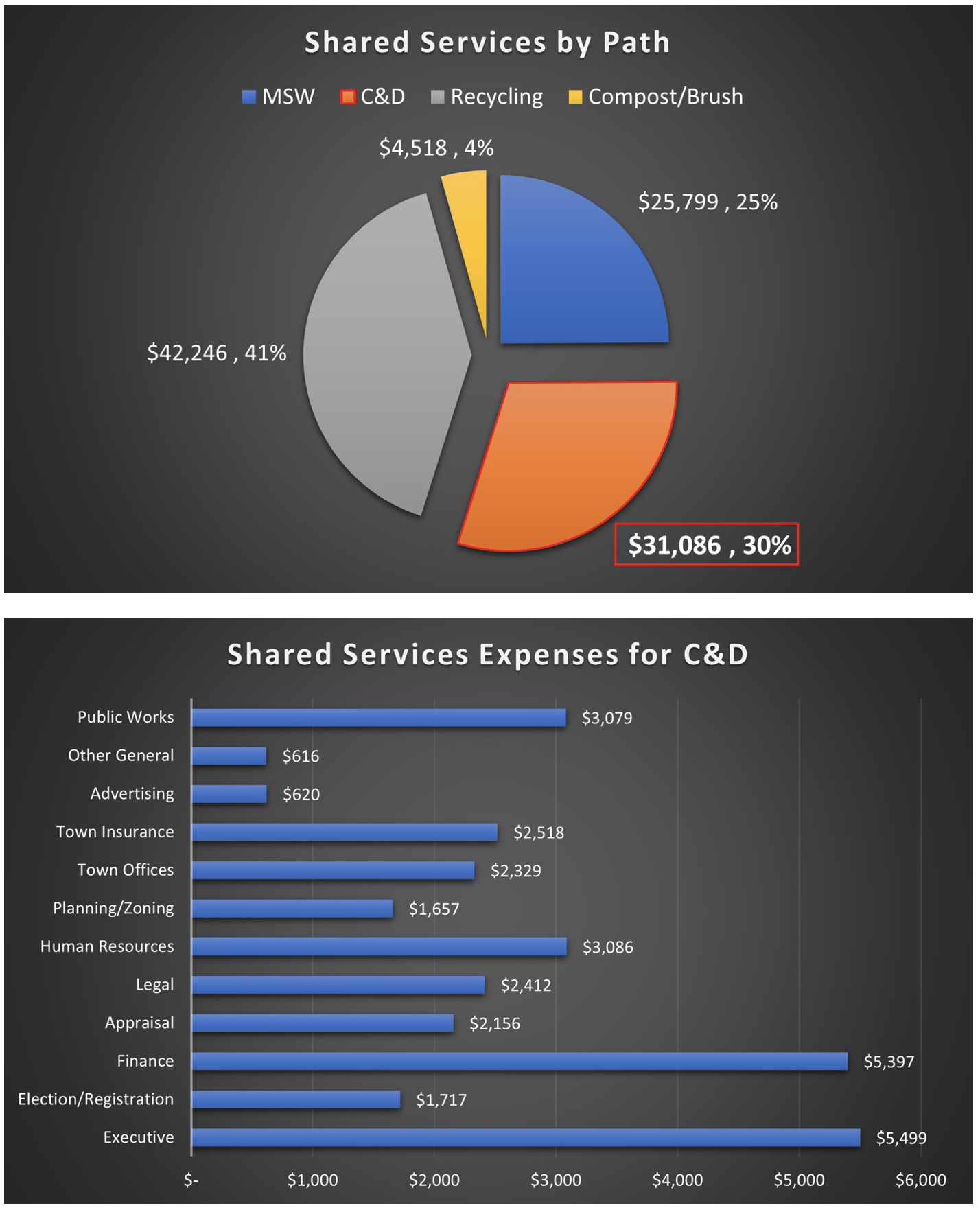

TOWN SHARED SERVICES: For the model and analysis, NRRA calculated that the Transfer Station had $103,649 in shared service expenses with other town departments. The Transfer Station was responsible for the use of approximately 5.8% of town departments such as finance, executive, public works, human resources, and others. This was calculated based on the percentage of the Transfer Station budget compared to the whole town budget.

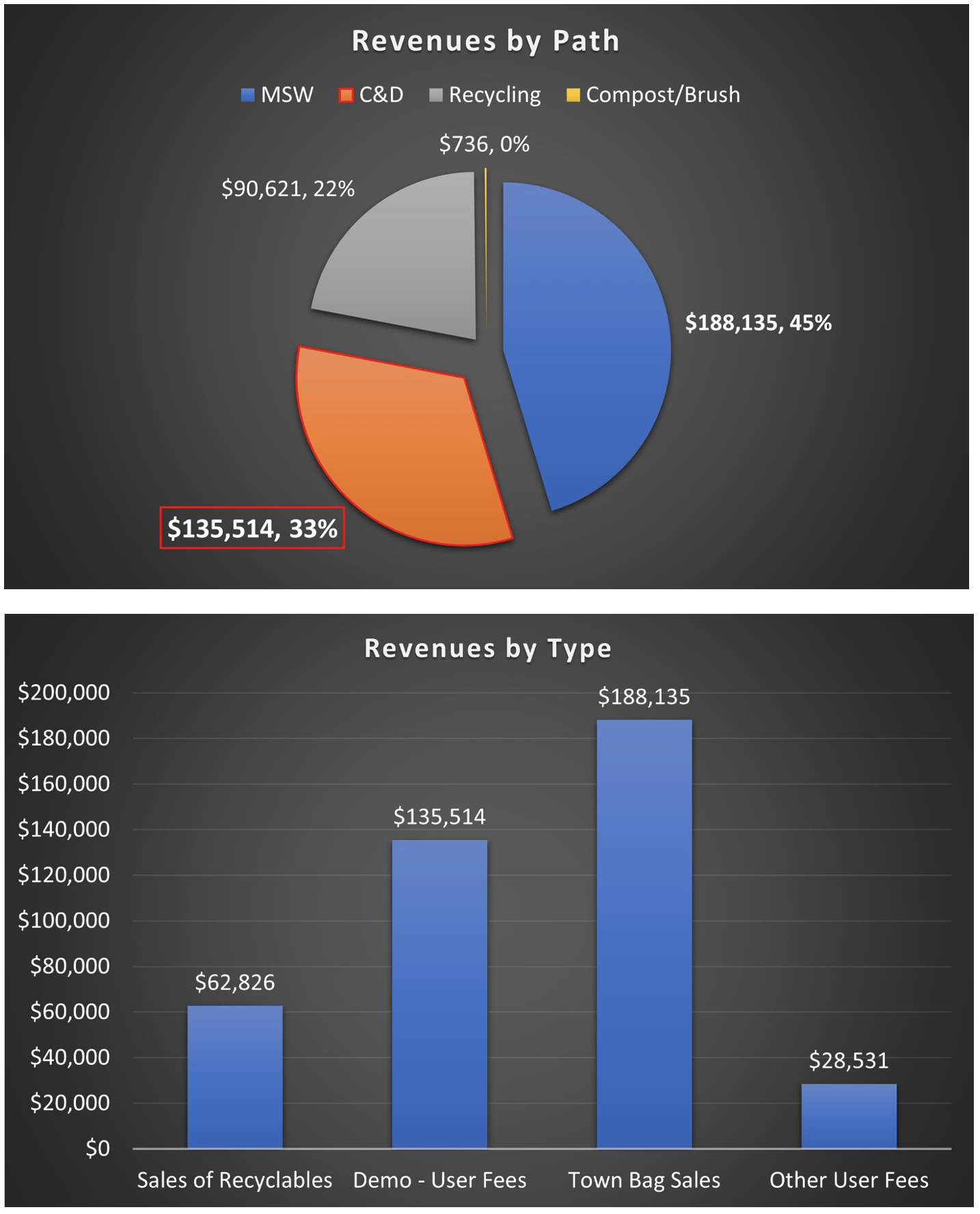

REVENUES: The Transfer Station took in $415,007 in revenue in 2023 with C&D being just under 33% of that. All C&D revenue came from user fees. The Transfer Station categorized asphalt shingles separately from C&D, but they were disposed of in the landfill instead of recycling. Shingles accounted for approximately 4.8% of the total C&D user fees collected. While the facility has separate user fees for bulky waste, all fees are run under the demolition account line.

SUMMARY: Overall, the Full Cost Accounting for Littleton, NH Transfer Station shows that the town was able to cover nearly 57% of its C&D expenses with user fees. That means 43% ($101,313) of the C&D expenses are not covered by user fees and are therefore covered by taxes. This equates to a net cost per ton expense of $147.26. For comparison, NRRA provided 5 other towns with an FCA analysis and the average net cost per ton for C&D from those 5 reports was $166 per ton. The range was from $29 per ton to $246 per ton.

Based on the FCA analysis, NRRA recommends that the town have a strategic discussion about opportunities for increasing C&D recycling and decreasing C&D costs using the following recommended discussion points.

Recommended discussion points:

- Should the town increase disposal costs to cover more than just tipping and transportation costs of C&D? By determining what the town would like covered – such as labor costs – in addition to tipping and transportation, the town will be able to better determine what the new fee rates should be.

- Should the town purchase a vehicle scale to accurately determine costs? The town is doing a good job covering basic costs, especially after raising fee rates midway through last year. However, the town is still estimating loads and would benefit from a truck scale like Lisbon, Ashland, or Gilford. (Additional information on scales can be found on the NRRA website at: https://www.nrrarecycles.org/waste-diversion-reduction-toolkits/scales-toolkit

- Should the town limit the amount or size of C&D loads accepted? This has been an ongoing, internal facility discussion for more than 6 years. As dump trailers get bigger in size, the Transfer Station is not well equipped to accept these loads, causing extra labor time and costs for staff. Other options would be to institute an additional fee for oversized trailers or increasing the C&D bay size.

- Should the town limit out of town material coming into the facility? Currently, Littleton is permitted to accept material from any town in New Hampshire. The facility accepts material from nearby towns, but it is difficult to track where material is coming from. If the town is losing money, does it want to continue to accept material generated outside of Littleton? Another option would be to have a specific fee schedule for out-of-town material.

- Should the town recycle some C&D instead of landfilling it? As tipping fees and transportation costs increase, the option to recycle some C&D – transported as a backhaul to a C&D recycling facility – will soon become close to, or less expensive than, the cost of landfilling. This could be an environmentally and economically sound option. It currently costs Littleton $186 per ton to landfill C&D, which includes transportation and tipping fees. A C&D Recycling Feasibility study completed by NRRA earlier this year, however, estimated that a 120 cubic yard backhaul would cost about $160 per ton. Recycling C&D would require site improvements to store 120 cubic yards of C&D. Bulky waste would continue to go into the pre-crusher and be sent to the landfill.

This project has been funded wholly or in part by the United States Environmental Protection Agency under assistance agreement 00A01024 to Northeast Resource Recovery Association. The contents of this document do not necessarily reflect the views and policies of the EPA.