NRRA staff recently spoke with a member community whose recycling committee and select board were shocked to learn that their community's costs for curbside single stream recycling is now one third more than their cost to dispose of trash. While the community doesn't market their curbside recycling through NRRA, they reached out to NRRA as a trusted resource to understand what's happening with recycling markets. The following information and charts are designed to help NRRA members understand the current recycling markets and share accurate information with local decision-makers in your community.

The Short Answer: The economy is expected to cool off because the Federal Reserve is raising interest rates to reduce inflation. That, in turn, reduces recycling market pricing during a slower economy.

The Details: In an effort to reduce high inflation, the Federal Reserve — the central bank of the United States — has been increasing the federal funds rate. The federal funds rate is essentially the target interest rate banks and other financial institutions pay to borrow funds. The goal of the Federal Reserve is to raise interest rates enough to slow down the economy and reduce the rate of inflation. A slower economy and rising interest rates decrease consumer spending, which in turn reduces demand for recycled materials as a feedstock for new products and packaging. Experts anticipate that the Federal Reserve will continue increasing rates through the end of 2022.

In addition, many manufacturers and retailers have had a difficult time predicting demand in this COVID/post-COVID economy. Retail stores have recently had high inventory due to lower sales as Americans spend more on services than consumer goods. High inventory lowers the demand for recycled material as feedstock for making new goods. We can expect to see the unemployment rate increase as the economy slows down, which will reduce consumer spending (though one silver lining is that reduced consumer spending tends to also reduce the amount of waste generated by consumers).

Impacts on Communities: As recyclable commodities decrease in value, communities with source separated recycling are receiving less revenue for their recyclables or even paying to recycle some materials. Communities with dual or single stream recycling based on variable rates are seeing their costs for those programs increase.

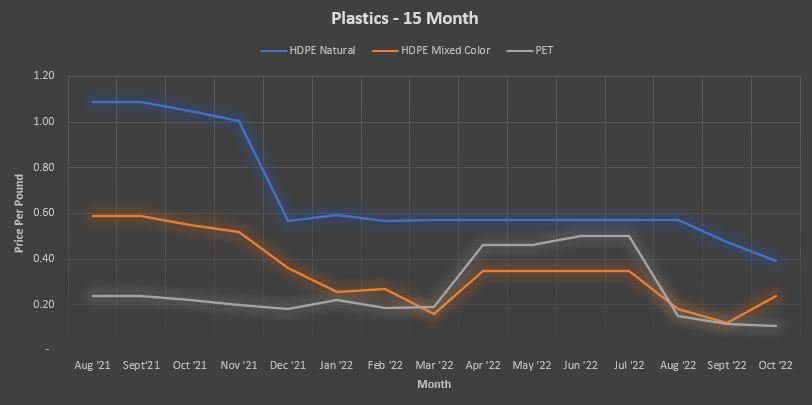

Market Pricing - Last 15 Months

As shown in the below charts based on market pricing through NRRA, most fibers and plastics saw price decreases in August, September, and October of 2022. Fibers pricing is an especially important indicator for the overall value of a residential recycling program, because fibers tend to comprise over half of all residential recycling by weight. When the price of cardboard and mixed paper — two major components of fibers in residential recycling programs — decrease dramatically, that drives down the value of the average ton of recyclables for a community.

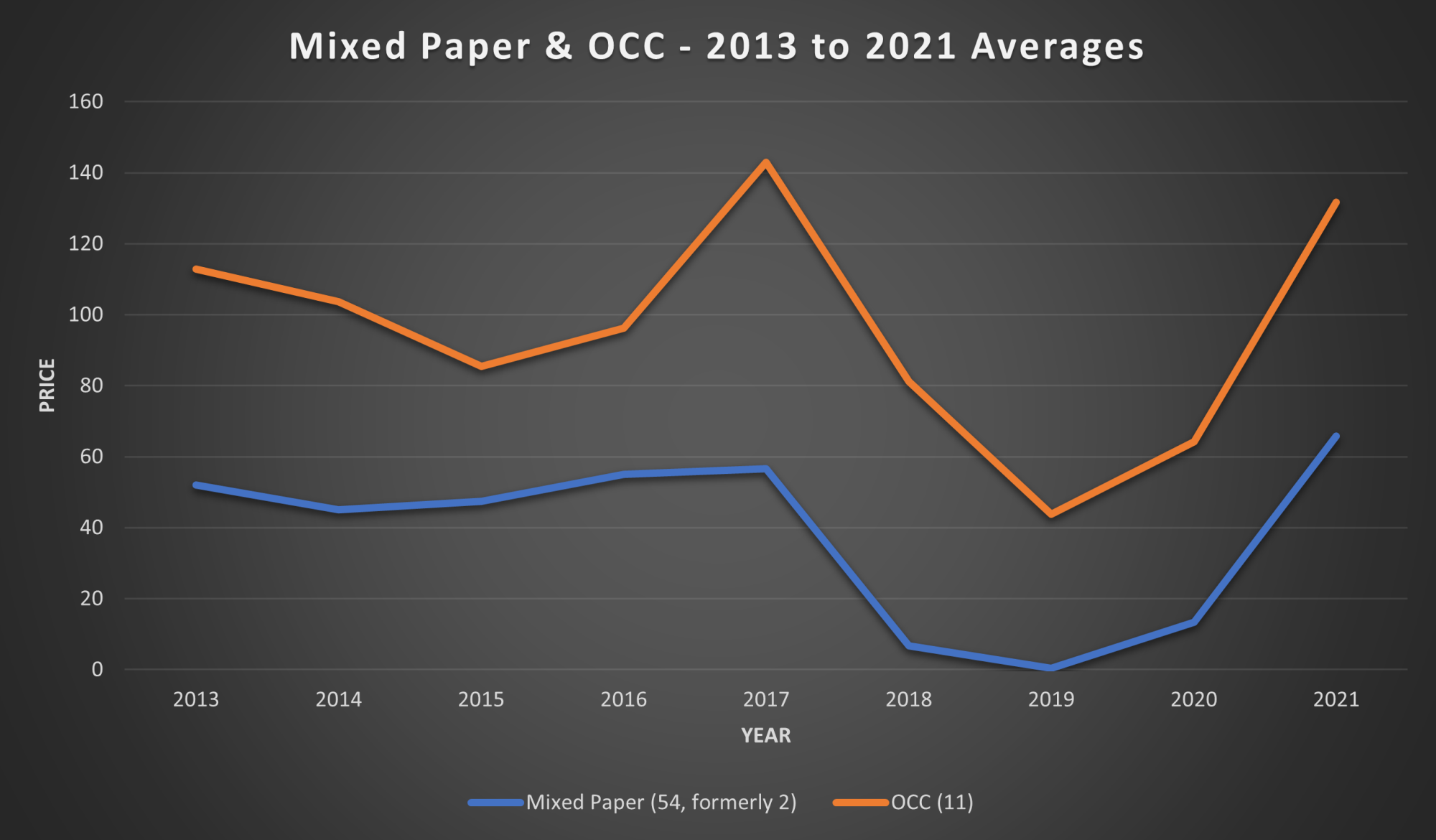

OCC stands for "old corrugated containers, which is cardboard with a corrugated liner. Mixed paper consists of various paper types mixed together. SOP stands for "sorted office papers," which is paper as typically generated by offices and a higher grade than mixed paper.

HDPE Natural is #2 high-density polyethylene plastic and has no pigment. Examples include translucent milk and apple cider jugs. HDPE Mixed Color is #2 high-density polyethylene plastic that is colored with pigment. Examples include colored laundry detergent bottles. PET is #1 polyethylene teraphthalate plastic. Examples include water and soda bottles.

Market Pricing - Prior Nine Year Averages

As demonstrated by the following charts, the average value for fibers and plastics increased significantly in 2021 before the current downturn in market pricing in late 2022. As shown by these charts, fluctuations in pricing for recyclable commodities are common over time.

Bottom Line: Recycling markets go up, and recycling markets go down. NRRA urges member communities to stay the course during this market downturn and avoid making drastic changes to recycling programs that will be difficult to reverse when recycling markets inevitably improve. If you have questions, please contact our Member Services Department for assistance.

NRRA would like to thank Joe Pickard, Chief Economist and Director of Commodities at the Institute of Scrap Recycling Industries (ISRI) and Chaz Miller, Chair of the Northeast Recycling Council (NERC) Regional Recycling Markets Committee for their recent informative presentations on this topic.